I like to think of myself as a capable analyst. I’ve been analyzing modeled output and large datasets for many years now, so I was naturally skeptical that an AI Agent could outperform me when it came to interpreting marketing data.

To test this, I staged a “shoot-out.” I built an AI Agent using the Gemini 2.0 Flash LLM, integrated my existing XGBoost propensity model code, and compared its analysis of the Bank Marketing Dataset to my own findings.

I was in for a surprise.

It is hard to compete with an always-on AI agent in terms of speed and scale. While a human analyst might identify top leads, an AI Agent has the capability to analyze each lead individually and generate marketing recommendations tailored to their specific demographics in seconds. This level of micro-segmentation at scale is simply not practical for a single analyst.

However, my experiment also proved that there are still massive advantages to having a “Human-In-The-Loop.”

The Foundation: The Propensity-to-Buy Workhorse

In a previous article, I built an ML classifier using the Bank Marketing Dataset from the UC Irvine repository (representing a real-world Portuguese bank campaign from 2008–2010). My initial human interpretation focused on the forensic view. Here is a sample of the data:

The model had good accuracy:

In my initial article on propensity-to-buy, I had four key findings based on the most influential model features:

- Primary Driver: Communication Method (Cellular). This was the strongest predictor of a purchase.

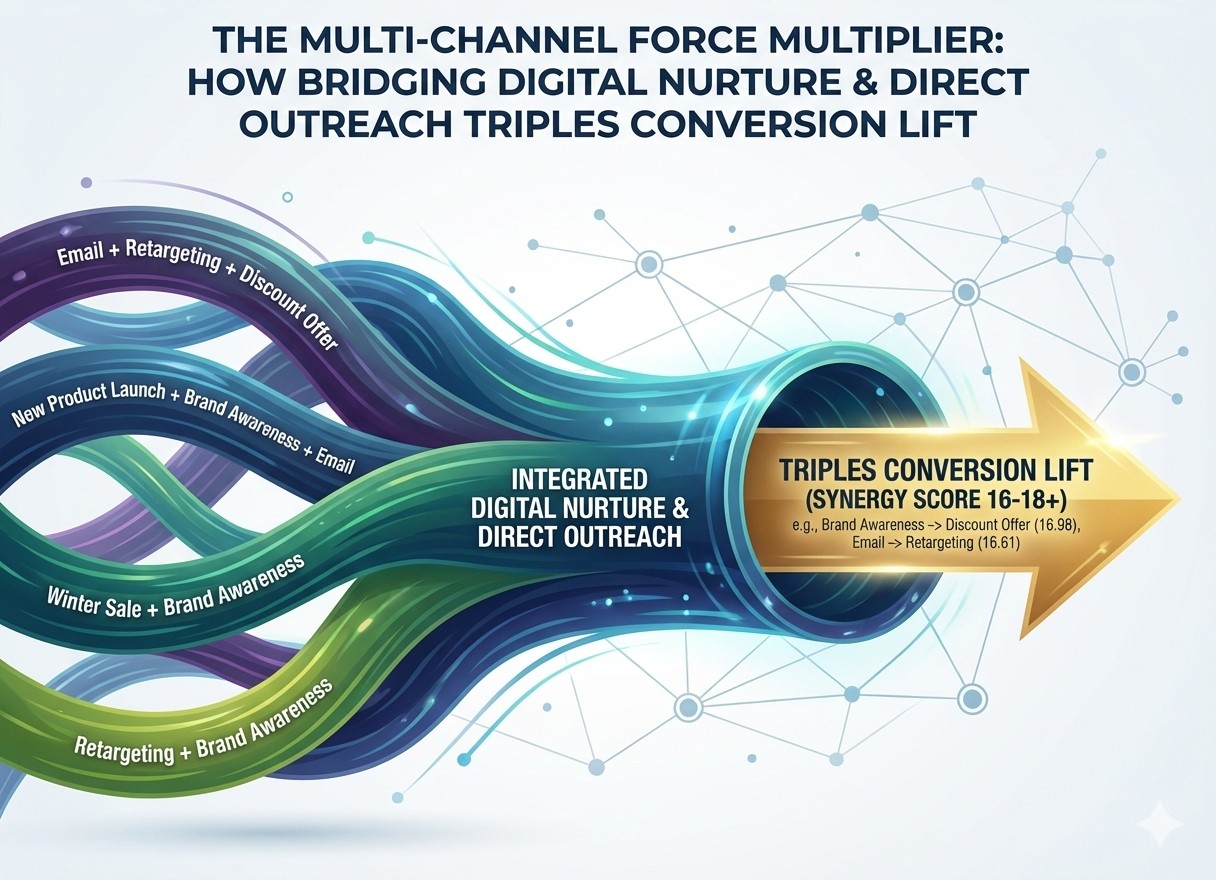

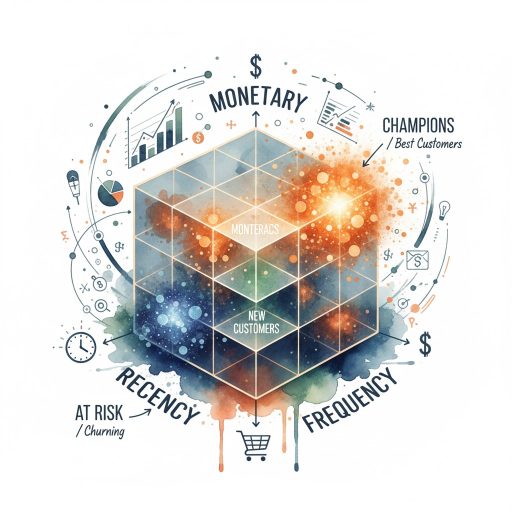

- The “Momentum” Effect: Success in previous campaigns (poutcome_success) was a massive indicator of future conversion, validating the importance of RFM (Recency/Frequency/Monetary) models.

- Financial Stability: Customers without housing loans and higher bank balances correlated positively with conversion.

- Timing: Outreach in specific months (June/March) influenced the model, suggesting seasonal adjustments for telemarketing programs.

The Challenger: The AI Agent

I wanted to see if an AI Agent could run my model and interpret the findings in a way that was actually actionable for a sales team. I provided the Agent with these System Instructions:

“You are a Senior Strategic Marketing Agent. Analyze these top leads, provide personalized pitch strategies, and reference specific rows to justify your advice.”

First, the Agent provided a profile of the Top 500 Leads, identifying that while the demographics varied, the common thread was the high propensity score and the success of previous outcomes.

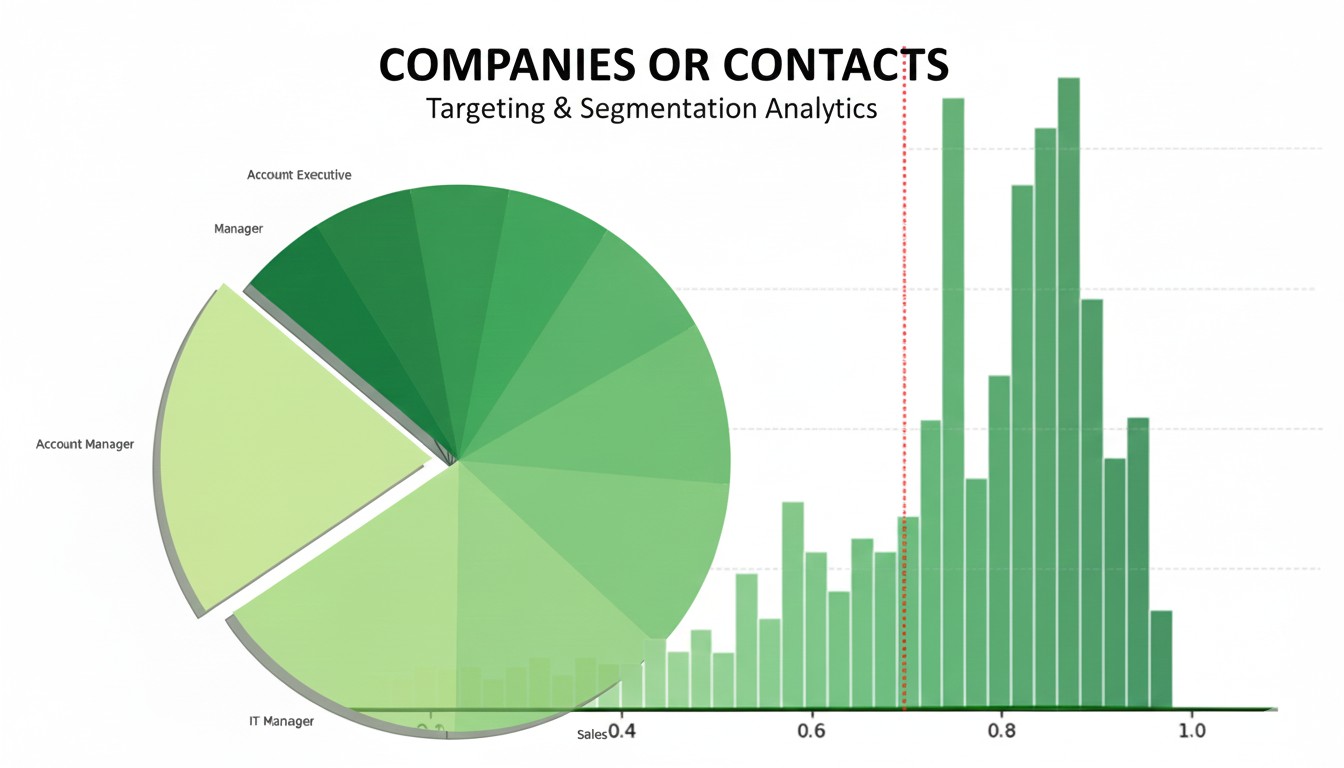

Note: As shown in the chart above, there isn’t a direct correlation between account balance and propensity—intent is far more complex than just a bank balance.

The Agent’s Strategic Brief (Verbatim Output):

Lead Profile Summary: The dataset contains a variety of demographics. Most leads own houses, don’t have loans, and prefer cellular contact. “Success” in previous campaigns is a dominant indicator.

Strategy 1: Young to Middle-Aged Professionals (Leads 1 & 2)

- Focus: Career advancement and financial stability. Highlight long-term planning.

- Subject Line: “[Name], Unlock Your Management Potential with [Product/Service]”

Strategy 2: Students (Lead 3)

- Focus: Education and skill-building. Promote affordable solutions.

- Subject Line: “[Name], Ace Your Studies and Future Career with [Product/Service]”

The Tree Map Reveal

The Agent then generated a tree map to visualize these segments. It quickly identified that Management and Administrative job titles weren’t just numerous, they represented a massive volume of the bank’s total account balance opportunity.

Agent Detailed Data Output And Top Lead Strategies

The dataset contains a variety of individuals with varying demographics, including:

- Age: Wide range, from teenagers to retirees.

- Job: Diverse occupations, including management, students, self-employed, technicians, etc.

- Marital Status: Mostly married or single.

- Education: Secondary and Tertiary education are common, with a few having Primary.

- Balance: Varies significantly.

- Housing/Loan: Mostly own houses and don’t have loans.

- Contact: Cellular is the primary mode of contact.

- Poutcome: “Success” in previous campaigns is a strong indicator.

- Propensity Score: All leads have very high propensity scores, indicating a high likelihood of conversion.

1. Strategy for Young to Middle-Aged Professionals (e.g., Leads 1 & 2):

- Focus: Career advancement and financial stability. Highlight products or services that aid in professional development, investment opportunities, or long-term financial planning.

- Messaging: Emphasize efficiency, time-saving benefits, and the potential for increased income or wealth.

- Channel: Utilize digital channels such as email, LinkedIn, and targeted online advertising.

- Personalized Email Subject Line (Lead 1): “\[Name], Unlock Your Management Potential with \[Product/Service]” Personalized Email Subject Line (Lead 2): “\[Name], Enhance Your Financial Security with \[Product/Service]”

2. Strategy for Students (e.g., Lead 3):

- Focus: Education, skill-building, and prospects. Promote products/services that enhance their learning experience, provide career guidance, or offer affordable financial solutions tailored to students.

- Messaging: Emphasize affordability, accessibility, and the potential for boosting their resume and job prospects.

- Channel: Utilize social media platforms popular among students (e.g., Instagram, TikTok), student-focused websites, and university partnerships.

- Personalized Email Subject Line (Lead 3): “\[Name], Ace Your Studies and Future Career with \[Product/Service]”

AI Agent Important Considerations:

- “Success” Poutcome: Since the “poutcome” is “success” for a prior campaign for all of these individuals, emphasize the proven track record and build on their positive past experiences.

- A/B Testing: Continuously test different messaging and channels to optimize results within each segment.

- Respect Privacy: Always adhere to privacy regulations and provide an easy way for recipients to opt-out of communications.

The Verdict: It’s a Draw (and a Win) – Human in the Loop is best!

- Mike has the edge relative to Context and Governance. The Agent suggested using TikTok to reach students—but TikTok didn’t exist when this data was collected in 2008! I know how to interpret data within its historical and social context.

- The AI Agent outperforms relative to Scale and Creative Iteration. It took my complex XGBoost output and, in seconds, generated three distinct GTM playbooks and 500 personalized subject lines; tasks that would take a marketing team days to do manually.

The Real Winner: The organization that uses a human-tuned predictive foundation (XGBoost) to feed an Agentic Execution Layer (Gemini). This combination allows us to operate with the precision of a statistician and the speed of an AI.

References & Further Reading

- Moro, S., Cortez, P., & Rita, P. (2014). A Data-Driven Approach to Predict the Success of Bank Telemarketing. Decision Support Systems, Elsevier, 62:22-31. [The definitive study for the Bank Marketing Dataset].

- UCI Machine Learning Repository. Bank Marketing Data Set. Available at: https://archive.ics.uci.edu/ml/datasets/Bank+Marketing

- Chen, T., & Guestrin, C. (2016). XGBoost: A Scalable Tree Boosting System. Proceedings of the 22nd ACM SIGKDD International Conference on Knowledge Discovery and Data Mining. [The foundational paper for the XGBoost algorithm].

- Google DeepMind. (2023). Gemini: A Family of Highly Capable Multimodal Models. Google Technical Report. [Context for the Agentic LLM used in the shoot-out].

- Fader, P. S., Hardie, B. G., & Lee, K. L. (2005). RFM and CLV: Using Iso-Value Curves for Customer Base Analysis. Journal of Marketing Research. [Supporting the Recency, Frequency, and Monetary value methodology].

- American Statistical Association (ASA). Ethical Guidelines for Statistical Practice. [Reference for the “Human-in-the-Loop” governance and ethical AI interpretation mentioned in the verdict].